November 2015 AKCPA Newsletter

Tim Christen (AICPA Chairman of the Board), Josh McIntyre and Barry Melancon (AICPA President and CEO)

President's Message

NOVEMBER 2015

During the month of October I attended two AICPA conferences, Oil and Gas, and the Fall Meeting of Governing Council. I had the opportunity to connect with others in business and industry, colleagues from my former firm BDO, and others who I have worked with in the past. At the Oil and Gas Conference I saw AKCPA member Dan Dickinson who joined BDO's Anchorage office just at the time that I was leaving. Dan and I have had the opportunity to work together on several occasions, the services he provides are immensely valuable to companies in the oil exploration business like mine. At the Meeting of Governing Council we had a contingent proudly representing AICPA members from Alaska. This included Lance Bodeen, Crista Burson, Rebecca Martin, John Rodgers, and myself. Over the years, through attending conferences, CPE, and other events, I have built relationships that have proven to be tremendously valuable.

The work that the AICPA does in putting together its conferences and the opportunity to take away new ideas and inspiration away from these events is phenomenal. The Oil and Gas Conference affirmed the importance and value of internal initiatives that my company is currently working on, allowed us to meet people from other oil companies, and provided some industry insight not available anywhere else. The AICPA Fall Meeting of Governing Council included a focus on the expanding importance and unique opportunity for the AICPA, working with England's Chartered Institute of Management Accountants (CIMA) to establish the Chartered Global Management Accountant (CGMA) credential as the premier global designation for accountants working in business and industry. Having a CPA license will remain a factor that continues to speak for itself, indicating the skills, education, and potential of anyone who holds it. The CGMA designation provides an opportunity for those who either went directly into business and industry from college, or those who have left public practice to signify the level of skill, education, and experience they have attained. I encourage you to read more about this here.

The Alaska State Board of Public Accountancy meets in Anchorage on November 12th and 13th. Many people have contacted me regarding the status of changes in regulations to eliminate Alaska's attest hour requirement. Attending the meeting or the AKCPA sponsored lunch on November 12th were good opportunities to learn more about the current status. I am excited about the prospect of welcoming many new CPAs who have only this regulation change as final barrier to qualifying to be licensed. The AKCPA will continue to watch this issue closely and keep members up to date.

AICPA Fall Council Meeting

Aloha from Hawaii

John Rodgers, CPA

I’ve recently returned from the AICPA Fall Meeting in Maui, Hawaii. While there, we braved the sun and sand, high surf, tropical rain storms and power outages to discuss the current topics affecting our industry. It was hilarious to identify the visitors from Alaska when the power went out because we all had head lamps and Leatherman’s.

Key items for this issue:

CPA exam changes - the CPA exam is changing in order to ensure candidates that pass the exam exhibit the appropriate level of technical knowledge and the fundamental skills for initial licensure. The proposed content and design are:

- Maintain the four current sections.

- Enhance breadth and depth of the exam.

- Add simulations to each section.

- Reallocate skill and content.

- Continue to assess writing in BEC.

The proposed changes include increased assessment of higher order skills, increased critical thinking and problem-solving, and overall will be more comprehensive. The new exams are expected to launch in April 2017.

National Commission on Diversity and Inclusion Update - Diversity continues to be a priority in the accounting profession. The Diversity Pipeline Project has three major initiatives:

- Increase communication and awareness in diverse communities.

- Increase support of school based programs for students pursuing accounting.

- Increase the number of underrepresented minorities that sit and pass the CPA exam.

CPA Pipeline Next Steps - Recruiting new accountants continues to be a priority for the industry. While improving the diversity and inclusion, focus should also be placed on getting young people interested in the field. The next steps include:

- Increase presence on campus.

- Expand reach beyond four-year colleges.

- Build relationships with academics.

Enhancing Audit Quality - the AICPA released the 6-Point Plan to Improve Audits in May 2015. This plan provides direction for integrating quality into each step of the audit process. Changes are coming which may end up causing issues for those that perform few audits each year.

Retired CPA Status - the Uniform Accountancy Act (UAA) had no retired status. The individual states had varied laws regarding retired CPA status. This caused plenty of confusion and was not often in the best interests of the public. A resolution was passed authorizing the board to create a “Retired CPA” status. These retired CPAs must continue competency in the services offered, but they may provide limited, uncompensated services including volunteer tax prep services and volunteer business mentoring.

Stay tuned for details regarding the continued progression of AICPA / CIMA joint venture / partnership.

Thank you for allowing me to represent Alaska CPAs at the meetings, and maintaining my Alaska tan!

Best regards,

John Rodgers

Alaska CPA Online License Renewal Now Open

Online renewal is now available: https://www.commerce.alaska.gov/cbp/professionallicense/renewselect.aspx

CPA Practice For Sale

This turn-key Anchorage practice for sale after 2016 tax season has annual gross revenues of about $390,000. It is a well-established practice of 30 years that has been providing quality tax and accounting services in the diverse Alaska market. Revenues are steady and mixed between tax work (70%), bookkeeping (15%) and other services (15%) to provide year-round income. The loyal client base composed largely of business and business owners, should continue to be an excellent referral source and provide opportunity for growth through expansion of services. The practice has a strong fee structure and produces solid cash flow to owner near 40% of gross. There is qualified staff in place at an established CPA office and seller is willing to work with buyer through a reasonable transition period. Asking price is $400,000. Inquiries should be directed to veronica@wcfcpa.net.

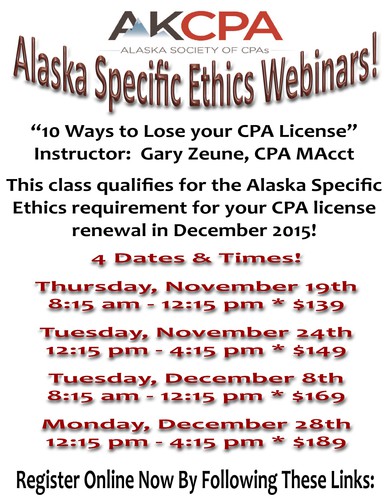

Thursday, November 19th, 8:15 am – 12:15 pm (Alaska Time):

http://cpe.cpacrossings.com/GZAKSE01W4?partner=akcpa

Tuesday, November 24th, 12:15 pm – 4:15 pm (Alaska Time):

http://cpe.cpacrossings.com/GZAKSE02W4?partner=akcpa

Tuesday, December 8th, 8:15 am – 12:15 pm (Alaska Time):

http://cpe.cpacrossings.com/GZAKSE03W4?partner=akcpa

Monday, December 28th, 12:15 pm – 4:15 pm (Alaska Time):

http://cpe.cpacrossings.com/GZAKSE04W4?partner=akcpa

NextGen AKCPA

NextGen Anchorage hosted their first fall Social featuring coffee and pastries at Coffee & Communitas on November 7th. Those in attendance were Crista Burson, Ray Pitka, Zack Poschin, Lisa Turner, Margarita Pelkhe, Evelyna Kuhr, Johnna Minemyer, Christopher Houde, Erich Lamirand, Diana Lopez and Thomas Huling.