January 2020 Newsletter

Crista Burson, Mark Schneiter, Kymberly Messersmith, Lindsay Patterson (AICPA), Amy Cooper and Melody Feniks enjoying a heated game of ping pong at AICPA Fall Council.

Amy Cooper and Mark Schneiter savoring the thrill of ping pong victory at AICPA Fall Council.

President's Message

January 2020

Notes from the Desk of Mr. Presidente’:

Evolution? Creationism? Who’s right? I believe in Evolution! I’m not talking about the human race and how it came to be, I’m talking about CPA EVOLUTION!! That is now the big push from the AICPA. I’ve heard 3 speeches from Barry Melancon and a few more “presentations” on the topic, and truthfully, I’m still not really sure what our “EVOLUTION” plan is. I understand that our profession needs to evolve. I mean, when I started I actually posted to a General Ledger using a pencil and, occasionally, an eraser (not often). I prepared tax returns by hand, for gawdsakes! Yes, I’m THAT old. I have now “evolved” to using a computer for almost everything. Of course I have to constantly ask how to do certain things, but that’s why we have “millennials”. I think that people must evolve in any profession. Things change. We adapt. However, the evolution being pushed by the AICPA is to “evolve” to the point where we will continue to attract the best and the brightest as we obviously have done in the past (especially the late 70’s, the “Golden Age” of CPAs). There seems to be a fear that the “core” accounting subjects of Financial Accounting; Auditing; Tax; with business law sprinkled in won’t be attractive to today’s youth. It is felt that we need to increase the emphasis on the big T, Technology. I agree. Many large firms are hiring more non CPA technology personnel than accounting personnel. This may be only a big firm issue, but even in a small firm like mine, technology plays a huge part.

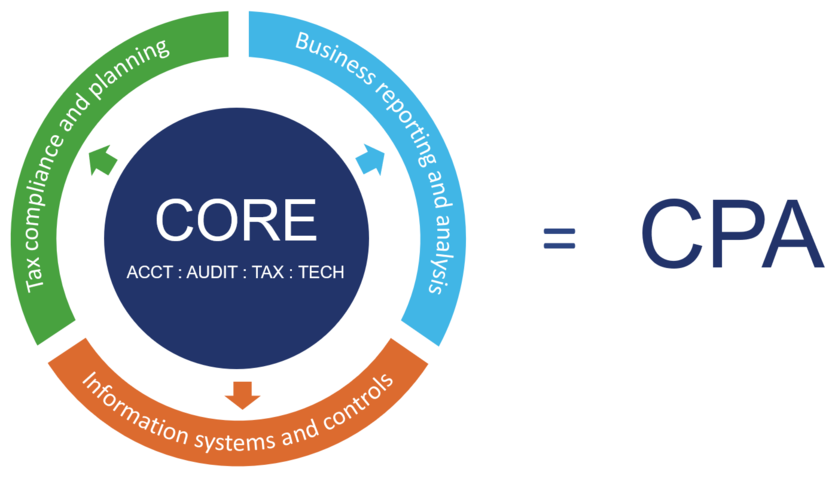

I’m just not sure how to do this, and I’m not sure the changes being proposed will bring about the desired result. The AICPA represents accountants who provide the attest function. We can’t get away from that fact. If we want our tech personnel to be CPAs, they still must be accountants. The AICPA acknowledges this by saying that the CPA exam will still test the “core” competencies mention above. But then a CPA candidate can determine if they want their additional section to be in “Information systems and controls” (tech); “Business reporting and analysis” (accounting and auditing) or “Tax compliance and planning”. There will be no additional designation such as “CPA–Tech” or “CPA-Tax”, so I’m not sure what this accomplishes other than making one section of the test more accessible to techies (or is it trekkies. That always confuses me).

Personally, I think our capitalist system will take care of whether young people want to become accountants. The demand for accountants has not diminished. If fewer people choose to become accountants, the competition for them will increase. Increased pay will follow. This will attract more into the profession. Capitalism at its best!

The AICPA has requested feedback on this topic. If anyone would like to comment on CPA Evolution, please submit to myself or Crista.

Mark Schneiter, CPA

Report from AICPA Fall Meeting of Council

Amy Cooper, CPA – Alaska Council Member

The 2019 Fall AICPA Conference was in Seattle. The main theme was Reimagine, with the key part of this theme being CPA Evolution. As Barry Melancon said in his presentation, we need to be agile and continuously reinventing if we are to remain relevant. If we were not clear on that by reading the agenda before the meeting, it became evident by the opening speaker – Jeffrey Rogers, a futurist. He led us through several principles of future thinking and left us with the ultimate question of how we change the value proposition of our work?

The CGMA exam is evolving. CIMA has changed the CGMA syllabus to be in line with the changing role of the finance function in companies. Digital skills are being embedded in in the CGMA exam throughout all areas. They are at the center of the skills that are tested – technology skills, business skills, leadership skills, and people skills. A new blueprint of the exam is being released in November and February.

According to the Pipeline Trends report, accounting enrollments and accounting graduates, at both the undergraduate and master’s level, are expected to be down 4%. In 2018, the hiring of new accounting graduates by U.S. public accounting firms is down 11% form 2016. The total decline since 2014 is 30%. Firms are hiring from other bachelor’s degrees – non-accounting majors. The AICPA remains “laser-focused” on the CPA pipeline.

Now for the CPA Evolution discussion. Bill Reeb, the current AICPA Chair, and Laurie Tish, the Vice Chair of the NASBA Board of Directors, discussed the CPA Evolution, an AICPA/NASBA joint initiative to evolve licensure, both education and the exam, and enhance public protection. The initiative began in early 2018 and they have gathered lots of feedback from multiple groups of stakeholders. They have drafted guiding principles and expect to have a new CPA exam model built out by 2020. They emphasized that the changes that have to happen to the exam has to be quick. In their creation of the model that was presented to us, they studied other professional licensure models were studied – legal, medical, engineering, etc. Seven different models were discussed and all of those on the task force for this initiative agreed on the same model. Under this new exam model, every CPA candidate has to pass a core exam that would include Accounting, Auditing, Tax and Technology. Each candidate would then choose a discipline to test a deeper skill in either business reporting and analysis; tax compliance and planning; or information systems and controls.

After their presentation, we had a break out session where we were asked to get into groups of 6-8 people. Mark Schneiter and I were at the same table with CPAs from several states. Each group was asked to classify a list of about 12 subjects for the core exam: should they subject be tested at a deep level, moderate level, limited level or not at all. The interesting part of this process was that everyone at our table was able to come to a consensus fairly quickly on which subjects should be tested at a deep level, moderate level, etc. The AICPA presented a recap of the break out session and the greatest core emphasis reflected our table’s order: audit and attest, principles and intermediate accounting, fundamentals of information systems and analytics and tax fundamentals. They recognize that there are a lot of logistical questions to be answered. Be prepared that the CPA exam model is going to change and change soon!

Additional topics discussed at Council were updates to CPA.com including progress on DAS, the Dynamic Auditing Solutions and the results of the PCPS CPA Firm Top Issues survey. Slides of most of the presentations are available if you would like them.

Best Regards,

Amy Cooper, AICPA Council Member

NASBA, AICPA propose new CPA licensure model

After reviewing input from stakeholders across the profession. NASBA and the AICPA proposed an approach to CPA licensure that they believe is responsive to that feedback while propelling the profession into the future. Read this Journal of Accountancy article and visit EvolutionOfCPA.org to learn more.

AKCPA Leadership Academy

Class of 2020

Meghan Carson, CPA

Meghan Carson is a financial advisor at Alaska Permanent Capital Management (APCM). She graduated from UAA in 2015 with a Bachelor of Arts in Economics and in 2017 with a Bachelor of Business Administration in Accounting. She began her post-college career in public accounting at Thomas, Head & Greisen, PC and obtained her CPA license in early 2019. First as staff accountant and later progressing to senior accountant, Meghan prepared and reviewed individual, business, and non-profit tax returns; provided bookkeeping and consulting services; and performed financial statement engagements including audits, reviews, and compilations. Earlier this year, Meghan made the transition to financial planning and investment management with a wonderful team she had previously interned with during her undergraduate studies. Passionate about both accounting and financial advice, Meghan feels her new career melds the best of both worlds. She enjoys working with individuals to determine their financial goals and to strategize the best implementation, all the while considering tax implications. A forever student, Meghan is now studying for her CFP® certification. With her participation on the board and finance committee for the Abused Women’s Aid in Crisis (AWAIC), the only emergency shelter for victims of domestic violence and sexual assault in Anchorage, Meghan is committed to supporting AWAIC’s mission of providing shelter, intervention, and prevention to end the cycle of abuse. A born and raised Alaskan, Meghan enjoys running outside, adventuring in the snow, and playing with her chocolate lab puppy, Lina.

Kristen Culver

Kristen Culver graduated from the University of Alaska Anchorage in 2016 with a Bachelor of Business Administration in Accounting. She is currently pursuing her CPA license. She is a member of the American Institute of Certified Public Accountants and the Alaska Society of Certified Public Accountants.

During college, Kristen had one tax internship and numerous audit internships at BDO. Upon graduating, she worked full time in the audit department. In February of 2019, Kristen started at Swalling & Associates as a senior associate where she works in attest on several industries including, but not limited to: construction, employee benefit plans, and non-profit companies.

In her spare time, Kristen enjoys country dancing, wine tasting, spending time with family and friends, and getting outdoors in our beautiful state.

Matthew Curley, CPA

Matthew Curley began his career in public accounting with the team at Walsh, Kelliher & Sharp in January 2014. Matt works on the preparation of individual, gift, estate, partnership and corporate tax returns, as well as financial statement preparation. In addition, he is involved with strategic and transition planning for closely held businesses.

He graduated from the University of Alaska Fairbanks with a Bachelor of Business Administration in Accounting in May of 2014 and a Master of Business Administration in December of 2017. Matt earned his CPA license in 2019. Matt is a member of the American Institute of Certified Public Accountants, Alaska Society of Certified Public Accountants and the Fairbanks Estate Planning Council.

Being a military brat, Matt was born in Victorville, California and spent his first 14 years relocating to different Air Force bases across the west coast. His family settled in Fairbanks in 2003 and they fell in love with the community, where he remains today. Today, his wife and two children spend as much time as possible taking advantage of everything this great state has to offer.

Dominique Kurth, CPA

Dominique grew up in Anchorage, and moved to the lower 48 in her early 20s to capture adventures living in Utah, Oregon, and Hawaii. During the late 90s she returned to Anchorage for a couple years and was hired as a receptionist by a local CPA, beginning what was to be a career in accounting. In 2003, she returned permanently to Alaska after concluding there is no substitute for the abundant opportunities provided in our great State. After a few years working a variety of jobs and building a bookkeeping client base, she decided to return to college to secure a more stable career with upward mobility in accounting. She graduated from UAA in Spring 2016 with a Bachelor’s in Business Administration in Accounting and Finance. She excelled in her studies and was inducted into Beta Gamma Sigma, an international business honor society that recognizes top performing students. She was active in Accounting Club during her time at UAA, serving as Vice President for one term, encouraging and mentoring younger students along the way. She was awarded an internship at BDO in the Assurance Department and accepted a part-time position with the firm after graduation which she recognized as temporary as she studied for and passed the CPA exams. In June of 2018 she became a licensed CPA in Alaska.

She kept in touch with that local CPA throughout her early career and time at UAA. He pushed her to achieve more, a bachelors degree instead of an associates, and then to go even further to meet the requirements to become a CPA which meant more school and a year to study for and pass the CPA exams. Eventually she was rewarded with her license and a position working with that local CPA, Mark Schneiter. Full-circle, 20 years later, she is learning about providing boutique tax advisory services to the small businesses and their owners in our community from one of the most knowledgeable CPAs in our State. Mark’s example of perseverance and dedication to our profession continues to push Dominique as she follows in his footsteps and becomes active in our local CPA society, keeping her on-track while our profession grows and adapts to the challenges faced by our profession in the years to come.

Stephanie Lambe-Musgrove, CPA

Stephanie Lambe-Musgrove is a partner at Lambe, Tuter, & Associates APC, an accounting firm in Soldotna, Alaska. Stephanie works with a number of tax clients ranging from personal, businesses and nonprofits. Stephanie also focuses in on-profit accounting for audits required for government audits. She completed her CPA license in the spring of 2014 and joined the firm a year later. Outside the office, Stephanie is found with her family, enjoying the Alaskan outdoors!

Tucker Langel, CPA

Tucker Langel is a licensed CPA by the State of Alaska (Certificate #136032). He joined Altman, Rogers & Co. in July 2016. Tucker has a BA degree in professional accountancy and a Master of Professional Accountancy (MPAc). He graduated from MSU Bozeman in May 2016. Tucker has over three years of auditing experience and is responsible for financial statement report writing and audit field work, including compliance with federal and state requirements. His experience is primarily focused on governmental and non-profit organizations with some nonpublic companies as well.

Outside of work he is member of the American Institute of Certified Public Accountants and the Alaska State Society of Certified Public Accountants and also services on the Board of Directors for the YMCA of Alaska.

Outside of work Tucker spends most of his time working on his home in Anchorage and spending time hiking, cross country skiing, and fishing with Isabella, his weimaraner, and Monica his girlfriend.

Ryan Masneri, CPA

Ryan Masneri is a life-long Alaskan who graduated from the University of Alaska Anchorage in 2015 with a Bachelor’s degree in Accounting. After graduation, he worked in public accounting with Grant Thornton LLP for three years. Here, Ryan worked on financial statement and internal control audits specializing in Alaska Native Corporations, telecommunications companies, and publicly traded entities. In addition to working with some of Alaska’s largest companies, Ryan has taken several opportunities on large-scale audits in the western lower 48. Since 2018, Ryan has been in an internal audit position with ASRC where he continues to grow as an auditor and accountant under one client.

In his free time, Ryan enjoys the Alaska outdoors as much as possible. Fishing, hiking, hunting, biking, camping, and skiing. When tired, Ryan enjoys reading, watching movies, playing novice guitar, and planning future travel destinations.

Hailey Messick

Hailey Messick is a Staff Accountant at Robinson and Ward, P.C. in Fairbanks, AK. She is a graduate from the University of Alaska Fairbanks where she obtained her Bachelor of Arts in Economics with a minor in Accounting. Currently, she is a CPA Candidate with one of four parts successfully completed. Some of her philanthropic efforts include coaching high school tennis in partnership with the Fairbanks Tennis Association, aiding with the silent auction at American Heart Association’s annual Go Red luncheon, and making blankets for the Fairbanks Women’s Shelter.

Jenn Opsahl, CPA

Jenn Opsahl, CPA, is a Senior Tax Associate at KPMG, LLP in Anchorage. She graduated from Montana State University with a bachelor’s degree in business and a master’s degree in accounting. She has worked with KPMG since moving to Alaska just after graduation. Outside of work Jenn enjoys time with her family as well as time spent outdoors hiking and kayaking.

Heather Schrage, CPA

Heather Schrage is a licensed CPA in the State of Alaska. She is currently a Senior Accountant at Thomas, Head & Greisen where she provides a variety of accounting services to her clients.

Heather is a graduate of University of Alaska Anchorage (UAA) with a Bachelor of Business Administration with a major in Accounting. Upon graduation, she was awarded UAA Leadership Honors.

Heather is a member of the American Institute of Certified Public Accountants (AICPA), Anchorage Estate Planning Council (AEPC), and Alaska Society of Certified Public Accountants (AKCPA). She currently serves as the Treasurer of the Abbott Loop Community Council, as a member of the AKCPA’s Legislative and Political Action Committees and is active with the Board of Friends of Pets. She has a passion for volunteering at local nonprofits, and in her free time she enjoys flying around southcentral Alaska with her husband, Calvin, and spending time with their family in McCarthy, Alaska.

Alaska Practitioner Liaison Meeting

12 05 2019 Practitioner Liaison Meeting Minutes

State of Alaska Board of Public Accountancy Report

John Rodgers, CPA – Board Liaison

I attended the State Board of Accountancy meeting on November 7th & 8th, 2019 as AKCPA board liaison. The purpose of the meeting was to review the updating of the state statutes. There were three major areas of discussion covered as well as a few items tabled for a later meeting.

The first point was to deliberate rewrites to the state’s definition of a “CPA firm”. These changes will give clarification to firms and practitioners in grey areas such as firms with only one CPA. Some of the issues are covered in regulations but not by the statutes themselves and the SBOPA would like to condense and simplify.

The second area of concern was permits for out of state practitioners coming into Alaska to perform attestation work. These changes are likely to follow many other states in adopting the ideals of “firm mobility” set out in the Uniform Accounting Act (UAA) which has wording to cover the various types of work performed.

The third topic was the changing of statute language from “quality review” to “peer review” which is actually the correct name. There was further conversation about creating a new “peer review” committee which would give the state access to viewing more than just public records as well as allowing for more state oversight into the process. This is a trend which is becoming more common in other states as well. All three of these topics will be covered in a bill to be introduced by Fairbanks Representative Republican Steve Thompson.

This meeting also brought up the need to review and clarify the educational requirements for licensing. The current standards and requirements are very broad and the board would like to define more specifically what mix of skills and classes will be required. This will likely be a focus of one of the upcoming meetings along with further discussion on auditing experience requirements.

The next meeting of the State Board of Accountancy is February 3rd & 4th in Anchorage.

Congratulations to newly licensed Alaskan CPAs:

ZACHARY DAMERON, MICHELLE GALLOWAY, HEIDI PICHLER, SAMUEL EPP, KEVIN OVERHOLT, LISA MARCINEK, MELISSA TALBERT, KIMBERLEY CONNAKER, TEODOR DORNEA, ZACHARY KENNEDY, THOMAS MCCLELLAND, MARISA DE LA TORRE, RACHEL HANKS, WILLIAM SOGGE & CRAIG OLLINGER!

Do you know of an AKCPA member that should be featured in our Member Spotlights section?! Email details to akcpa@ak.net.