March 2022 Newsletter

Evelyna Caldwell, CPA by day and by night.

President's Message

March 2022

It seems that the pandemic is slowing, and restrictions are loosening, so Crista and I (mostly Crista) decided it would be good to get back on track with our quarterly newsletters. Although it is nearing the end of my term, I wanted to take this opportunity to introduce myself to our members who haven’t met me and talk a little bit about why I love the Alaska Society of CPAs (AKCPA).

As for my background, I took my first accounting class in 2005 back in Fairbanks…. and I hated it. I think I even dropped it without finishing the semester. I liked math but why did we need debits and credits? And T accounts? After moving to Anchorage and working with a little bit of accounts payable and accounts receivable, I decided to give it a try, but just online. I’m not sure what changed, but now it wasn’t so bad. But my true love of accounting came from my first class with our most recent Past-President Stasia Straley. Anyone who has taken a class from Stasia knows how infectious her excitement about accounting can be, and what an incredible teacher she is, making hard concepts easy to understand.

After starting school with Stasia, I moved to the accounting department at my employer’s sister company. I spent 4 years moving through the positions: accounts receivable, accounts payable, and eventually some bank reconciliations. As I continued through school my only dream was to be controller and then CFO for this company. Because that job required you to have your CPA license, I knew I would have to leave and enter the dreaded field of public accounting. I remember telling Stasia how much I was sure I would hate it. I told her I wouldn’t be invested in my clients’ success like I am with one that is my employer (wrong) that I would not build the relationships I had with my co-workers (wrong) and that I wanted to get in and out as quickly as possible (way wrong).

I had an opportunity to work for Mikunda Cottrell that I will be forever grateful for. I was still working through my associates degree and was able to put that into practice in their bookkeeping department. I found I loved my co-workers more than any before (when my co-worker said I “fit in” I almost cried) and I formed strong relationships with my clients and was very invested in their success. Shortly after completing my bachelor’s degree, I was offered a position as assistant controller for my former employer, but now my dreams had changed. I loved public accounting in a way I couldn’t have understood without doing it myself.

I spent 4 years with MCC, about half in bookkeeping and half in tax. Being the slightly “overconfident” person I was at the time, I decided to start my own tax and bookkeeping firm. I didn’t even have my CPA license yet (just finishing up my 150-credit hour requirement by taking things like dog mushing and first aid), but I knew it was what I needed to do. I took the test to become an enrolled agent while I worked on finishing my CPA requirements. I learned a lot from those tests that I hadn’t learned in my 4 years at MCC or from passing the four parts of the CPA exam or from my associates and bachelor’s degree. To this day I am protective when there is animosity towards EAs.

Today my business has 6 employees (and 2 regular contractors) and is always busy. I owe much of this success to the support of the CPA society members. You can hear me brag often about how our community is more supportive than competitive. My business started with a lot of support from prior past president Mark Schneiter. I have learned so much at our Managing an Accounting Practice (MAP) breakfast and our bi-weekly Tax Round Table meetings. One of my favorite CPA society events is to blow off steam with other CPAs on April 15th (or whatever date they say the taxes are due nowadays) and October 15th. I would say that 75% of my referrals in the past have come from other CPAs. I have made lifelong friendships with the CPAs I met through the AKCPA. And of course, cannot say enough about our loving leader Crista who makes every member feel supported and special. The success of my business is not just from the work I do (although there is a lot of that), but from my employees and from the support of this society. It is priceless to me (don’t worry, we won’t test that theory with skyrocketing dues). While some CPAs may see the society as a way to get Continuing Education (and with more and more routes to get it, see their membership as less valuable), I see a community you can be part of that is more than worth the cost.

TLDR (too long didn’t read), the AKCPA is an amazing community that we are all fortunate to be a part of if we take the time to involve ourselves in the services offered, and please come to the first in person Annual Meeting since 2019 in Homer, May 25th – 27th at the Land’s End Resort! I can’t wait to see all of you there and hope to meet even more new friends.

Bill Pirolli (Chair, AICPA Board of Directors), Barry Mellancon (CEO, AICPA), Crista Burson (President & CEO, AKCPA) and Evelyna Caldwell (President, AKCPA Board of Directors) attend a virtual Meet & Greet during the 2021 CPA/SEA & AICPA Leadership Conference.

Alaska Practitioner Liaison Meeting Minutes

February 16th, 2022 Meeting Minutes

January 19th, 2022 Meeting Minutes

December 7th, 2021 Meeting Minutes

Annual AKCPA Awards Nominations Open

AKCPA Jay A. Ofsthun Distinguished Service Award Nomation Form

AKCPA Public Service Award Nomination Form

A Note from Crista Burson's Desk

The past two years have brought many challenges. I feel like there were many opportunities, too. It seems the entire planet learned to continue working and for many in an entirely different way. CPAs worked tirelessly to support and advocate for clients and businesses during the pandemic. Never were trusted client advisors more in demand. I have never been prouder to work with the accounting profession. Thank you for all each of you have done and continue to do to support our communities.

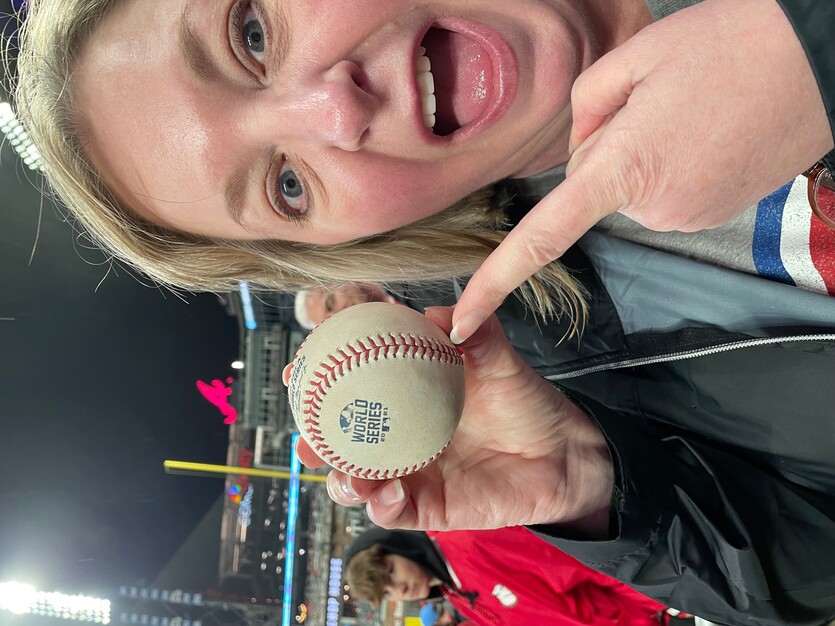

As in person events ceased, like many of you I spent more time at home. As an extroverted, extrovert it took me a bit of time to adjust. Ultimately, I feel like I have more balance these days and for that I am thankful. I became an obsessive puzzler. I stopped counting at 37 puzzles completed. I have always loved cooking, but I started trying things I’d never done before…such as pasta making. I read more. I also devoured every True Crime or Cult documentary I could find. One of my first trips outside Alaska in two years was to visit a dear friend I've had since I was in 5th grade. Lori invited me to Atlanta to attend Game 3 of the World Series. This was a once in a lifetime opportunity! I grew up going to Braves games...there was no way I could miss this. Our seats were 12 rows behind the Braves' dugout. At the top of the 6th inning a foul ball came whizzing over the dugout, through the nets, straight towards us. I raised my right hand and caught the ball!! It was surreal!! Fans in seats around me were screaming, high fiving me and asking for pictures...it was bananas. Definitely a 2021 highlight for me.

I’ve missed spending time with AKCPA members and look forward to getting back together in person and hearing everything each of you have been up to!

Crista Burson, President & CEO

Congratulations to newly licensed Alaskan CPAs:

STEPHANIE HUGHES, JOSHUA O'LEARY, KARI PAULSON, CHANDLER D'AGOSTINO, TYRONE CASTEEL, JUDITH MOOSE, ANN MARIE BELLOTTI-CLARK, TIMOTHY LEWIS, HUNTER ROMBERG, LETA WAGGENER & HAILEY MESSICK!

Do you know of an AKCPA member that should be featured in our Member Spotlights section?! Email details to akcpa@ak.net.

Transition Policy Announced for the 2024 CPA Exam Under the CPA Evolution Initiative

Have you heard of the CPA Evolution initiative? Are you aware that the Uniform CPA Examination (CPA Exam) is changing significantly in January 2024? It is important that you learn about this initiative and the upcoming changes to the CPA Exam to fully understand how it might impact your journey to CPA licensure. If you pass and retain credit for all four CPA Exam sections by December 31, 2023, the changes to the CPA Exam will NOT impact your journey. If you will still be working your way through the CPA Exam in January 2024 and beyond, then the information about the CPA Evolution-aligned CPA Exam (the 2024 CPA Exam) and transition policy are most important to understand.

It’s never been a more exciting time to pursue the CPA license. The role of today’s CPA has evolved, and newly licensed CPAs are taking on increased responsibilities that were traditionally assigned to more experienced staff. Becoming a CPA means you’ll need greater skill sets and competencies, and a greater knowledge of emerging technologies. That is why the CPA Evolution initiative is underway. It is a joint effort of the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA).

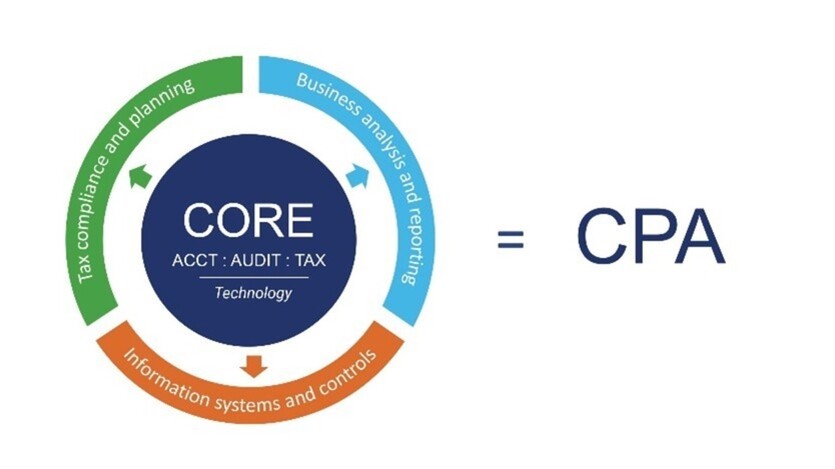

The new CPA licensure and CPA Exam model is a Core + Discipline model. The model starts with a robust core in accounting, auditing, and tax that all candidates will have to complete. Then, each candidate must choose a Discipline section in which to demonstrate greater skills and knowledge. Technology knowledge and skills will be tested in all sections, as it pertains to each section. Regardless of a candidate’s chosen discipline, this model leads to a full CPA license, with rights and privileges consistent with any other CPA. The Discipline section selected for testing does not mean the CPA is limited to that practice area.

The new Disciplines reflect three pillars of the CPA profession:

- Business analysis and reporting (BAR)

- Information systems and controls (ISC)

- Tax compliance and planning (TCP)

If you anticipate continuing your CPA Exam journey into 2024 and beyond, the much-anticipated transition policy is important news. This policy lays out how CPA Exam sections passed under the current CPA Exam map to credit under the 2024 CPA Exam. Transition policies like this have been necessary at other times when significant changes were made to the CPA Exam, such as when it was computerized in April 2004.

The policy was recommended to the Boards of Accountancy by the NASBA CBT Administration Committee after development and much deliberation by a task force with state board representatives from the AICPA Board of Examiners, sitting state board members and executive directors from multiple states. Because of the significant differences in the current and 2024 CPA Exams and the overall CPA licensure model, a perfect transition is not possible. The Boards of Accountancy have agreed this transition policy best serves the candidates, the state boards and the public interest.

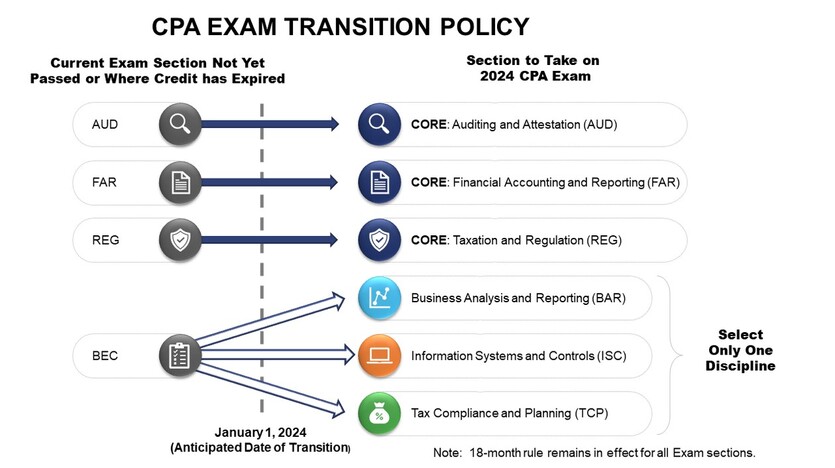

The transition policy is quite simple. Candidates who have credit for AUD, FAR or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR or REG on the 2024 CPA Exam. Candidates who have credit for BEC on the current CPA Exam will not need to take any of the three discipline sections.

If, however, a candidate loses credit for AUD, FAR or REG after December 31, 2023, they then must take the corresponding new Core section of AUD, FAR or REG. A candidate who loses credit for BEC after December 31, 2023, must select one of the three Discipline sections to be tested. It is important to note that none of the sections of the current CPA Exam will be available for testing after December 31, 2023. There is a hard cutover from the current CPA Exam sections to the 2024 CPA Exam sections on the January 2024 launch.

The following chart lays out the transition policy for each Exam section.

The CPA profession is at an exciting juncture as it moves to the CPA Evolution model. To prepare for the 2024 CPA Exam launch, the Exposure Draft of the 2024 CPA Exam, which includes the draft Blueprints, will be released by the AICPA on July 1, 2022, and will outline the content and skills proposed for each section of the 2024 CPA Exam. The 2024 CPA Exam Final Report, which will include the final Blueprints, is scheduled to be released in January 2023, a year before the 2024 CPA Exam launches.

FAQs are available that might answer some of your more detailed questions regarding the newly released transition policy.

Addtional information and FAQs regardng the CPA Evolution initiative are available at EvolutionofCPA.org. If your questions on the new CPE licensure model, examination and transition policy are still not answered, please contact Feedback@EvolutionofCPA.org.

For more information on becoming a CPA, please visit This Way to CPA.

Sourcing a Strong Candidate Pool is Pushing Firms Outside Their Comfort Zone

By Emily Franchi

CAMICO Loss Prevention Specialist

Employee and candidate demands for a flexible schedule or remote working environment are pushing accounting firms outside of their comfort zone as they try to remain competitive. Firms that have not considered allowing employees to work in a remote environment in the past, citing security and control reasons, are now finding themselves with a limited local candidate pool and the threat of an employee exodus in search of a more flexible work environment.

It seems that no industry is immune from a lack of labor, even in the professional classifications such as accountants. “Help Wanted” signs are the “new normal” and a literal sign of the times. To maintain staffing levels to support client needs, firms are struggling to source a strong candidate pool from local candidates and are now looking outside their local areas and even in other states to find qualified candidates.

In addition, the demand for a competitive compensation package is stronger than ever as the candidate pool has the upper hand. Employees can work for firms located in any state while living in an area with a lower cost of living and in turn enjoying a better quality of life.

Of course, a remote workforce can bring greater risk to the firm. As firms consider the various factors to support a remote workforce, there are a few items to keep in mind.

- Consider conducting background checks on candidates who rise to the top of the list and are offered a position. Contact the candidate’s references and ask about work habits, strengths, and weaknesses. Many past employers will shy away from providing such detail, but it doesn’t hurt to ask.

- Review and update policies that impact a remote work group such as cyber safety, use of firm resources, and care of client files.

- Create a checklist for an employee’s home office to ensure cyber safety and address issues such as a firewall, secured network, remote swipe, and firm-provided phone.

Once remote employees are onboard, firms must ensure that processes are keeping employees engaged, heard, and feeling valued. Create opportunities for engagement and have a solid Remote Workers Policy that addresses expectations of a remote worker. Such a policy may address:

- Employees should be available and engaged during regular business hours.

- While the employee’s remote office need not be a dedicated room or office space necessarily, the space should be free from distractions, pets, and young children, and allow for a secure space where firm and client information cannot be accessed by others, and phone calls are private.

- Express expectations related to meetings on Zoom, Teams and other virtual meeting platforms. Address issues such as requiring the employee to have their camera on or allowing them to keep the camera off, dress code while on virtual meetings, and backgrounds.

The accounting firm of the future is here. With the advice of a risk management advisor, firms can gain an understanding of potential risk and create best practices to support the new workplace of today.

Emily Franchi is the loss prevention specialist for employment practices with CAMICO Mutual Insurance Company (www.camico.com). She provides CAMICO policyholders who have Employment Practices Liability coverage with support on a variety of human resources management issues, focusing on employee relations and legislative compliance for the workplace. Franchi works with policyholders to reduce exposure to potential employment practices claims, and she provides education and assistance in creating professional work environments.

____________________________